Installment loans can be obtained by a venture – Installment loans have emerged as a prominent funding mechanism for ventures, offering a flexible and structured approach to financing. This comprehensive guide delves into the intricacies of installment loans, exploring their eligibility criteria, benefits, and implications for ventures.

Installment loans are characterized by their fixed repayment schedules, predetermined interest rates, and loan amounts tailored to specific venture needs. They provide ventures with access to capital without diluting ownership or incurring excessive interest charges.

Understanding Installment Loans

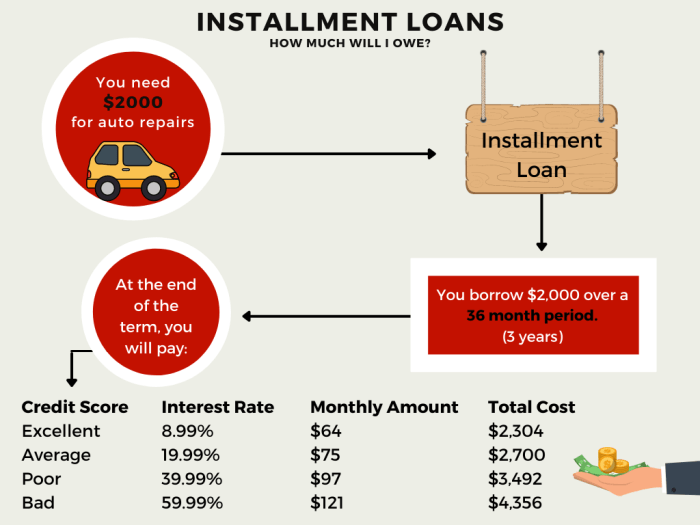

Installment loans are a type of financing that allows borrowers to receive a lump sum of money and repay it over a fixed period of time, typically in monthly installments. These loans are characterized by:

- Fixed loan amount

- Fixed interest rate

- Fixed repayment terms

Common uses for installment loans include:

- Purchasing a vehicle

- Financing a home renovation

- Consolidating debt

Eligibility for Installment Loans

Eligibility criteria for installment loans vary depending on the lender, but typically include:

- Minimum credit score

- Stable income

- Debt-to-income ratio within acceptable limits

Lenders evaluate loan applications based on factors such as:

- Credit history

- Income stability

- Employment history

A good credit history and stable income are crucial for obtaining favorable loan terms.

Obtaining Installment Loans for Ventures: Installment Loans Can Be Obtained By A Venture

Installment loans can benefit ventures by providing access to capital for:

- Purchasing equipment

- Hiring staff

- Expanding operations

Specific scenarios where installment loans may be appropriate for ventures include:

- When the venture has a stable cash flow but needs a short-term injection of capital

- When the venture is not yet eligible for equity financing

- When the venture needs to avoid diluting ownership

Advantages of using installment loans for ventures include:

- Fixed repayment schedule

- Predictable interest rates

- Potential tax deductions

Disadvantages include:

- Interest charges

- Risk of default

- Potential impact on credit score

Repayment Considerations

Installment loans typically have a fixed repayment schedule, with monthly payments due on a specific date.

Consequences of late or missed payments include:

- Late fees

- Damage to credit score

- Potential default

Strategies for managing installment loan repayments effectively include:

- Setting up automatic payments

- Creating a budget that includes loan payments

- Negotiating with the lender in case of financial hardship

Alternative Funding Options

Alternative funding options available to ventures besides installment loans include:

- Equity financing

- Business lines of credit

- Government grants

Installment loans differ from other funding options in terms of:

- Repayment terms

- Interest rates

- Ownership dilution

The most suitable funding option for a venture depends on factors such as:

- Venture stage

- Cash flow

- Growth potential

Frequently Asked Questions

What are the typical eligibility criteria for installment loans?

Lenders typically consider factors such as credit history, income stability, debt-to-income ratio, and the venture’s financial projections.

How do installment loans benefit ventures?

Installment loans provide ventures with access to capital, improve cash flow management, and support expansion or acquisition initiatives.

What are the advantages of using installment loans for ventures?

Advantages include fixed interest rates, predictable repayment schedules, and the ability to secure larger loan amounts compared to other funding options.